Saudi Arabia AR

Saudi Arabia AR Saudi Arabia AR

Saudi Arabia AR

Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformations. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

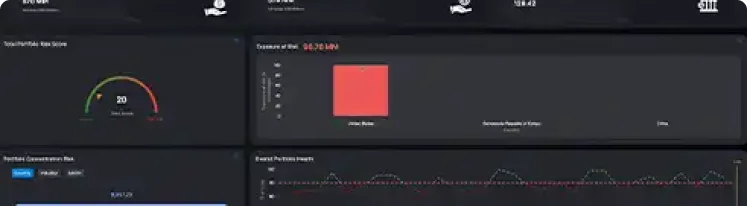

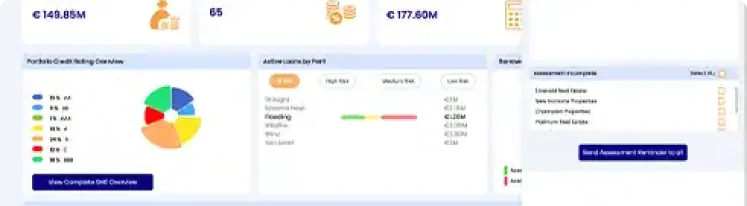

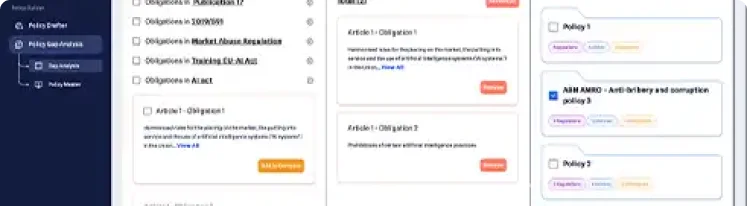

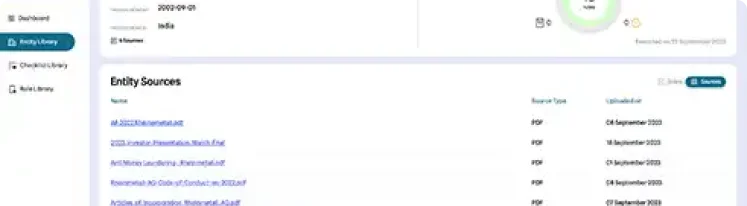

Advance your risk management initiatives with systems, platforms and tools that use sophisticated AI and GenAI models and modern strategies to better identify/foresee, explore and mitigate potential risks.

Automate processes and tasks across common -- and emerging -- business risk areas with solutions aimed at reducing time-consuming manual tasks and human errors, while enabling fresh risk perspectives for early, best actions.

Realize cost-savings and boost efficiencies through the implementation of cutting-edge new risk mitigation tools to heighten perspectives, allow forward-looking and chatbot-led analysis, and accomplish more.

Support managers of lending portfolios, regulatory implementation/change specialists, information security personnel, and KYC analysts with strategic tools to rapidly flag and resolve points of risk.

Empower your risk mitigation processes