Our FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the regulatory compliance realm.

Synechron's proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand client's most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Simplify regulations and amplify efficiency

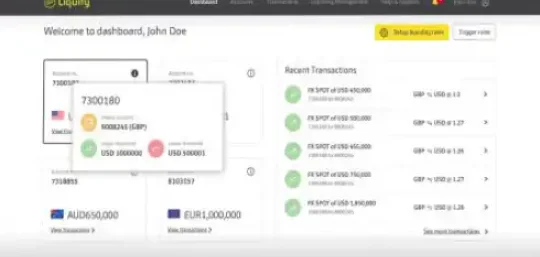

Automate and optimize your compliance processes. Enable real-time analysis and reporting, ensuring adherence to international regulations like IFRS 9, GAAP, and Basel standards. Streamlining reduces the risk of non-compliance and associated fines, while freeing up resources to focus on core business activities.

Leverage advanced technologies like AI and ML for more accurate and efficient risk management. Provide detailed insights into credit risks, trading strategies, and control breaches enabling proactive risk management and informed decision-making at all levels.

Simplify complex financial reporting requirements across different jurisdictions. Standardize and automate profit and loss calculations, expected loss assessments, and more, offering a consolidated view of financial health and facilitating informed strategic planning.

Confidently manage your unstructured data. Automate data classification, retention, and compliance, ensuring that your data governance meets the highest standards. Minimizes the risk of data mishandling and enhance overall data quality.

Automate and optimize your compliance processes. Enable real-time analysis and reporting, ensuring adherence to international regulations like IFRS 9, GAAP, and Basel standards. Streamlining reduces the risk of non-compliance and associated fines, while freeing up resources to focus on core business activities.

Leverage advanced technologies like AI and ML for more accurate and efficient risk management. Provide detailed insights into credit risks, trading strategies, and control breaches enabling proactive risk management and informed decision-making at all levels.

Simplify complex financial reporting requirements across different jurisdictions. Standardize and automate profit and loss calculations, expected loss assessments, and more, offering a consolidated view of financial health and facilitating informed strategic planning.

Confidently manage your unstructured data. Automate data classification, retention, and compliance, ensuring that your data governance meets the highest standards. Minimizes the risk of data mishandling and enhance overall data quality.

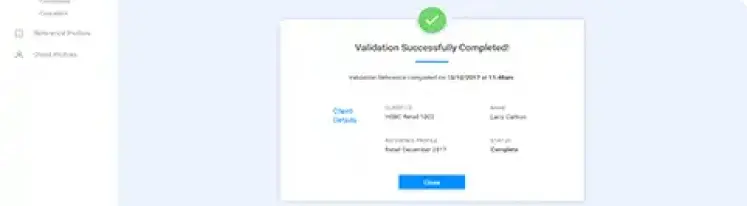

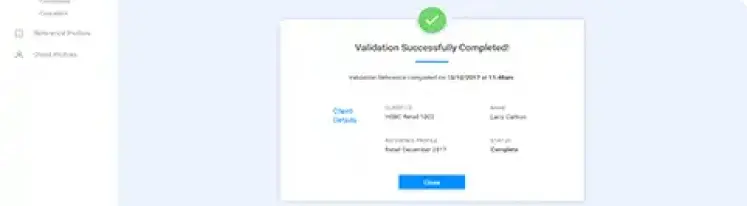

Know Your Customer (KYC) Remediation is a strategic approach to address the challenges of anti-money laundering (AML) and KYC regulations. It leverages advanced technologies like Optical Character Recognition (OCR) and Natural Language Processing (NLP) to automate and streamline the KYC process. Remediation time and errors are significantly reduced while accurate, up-to-date and compliant client data is ensured.

Revolutionizes the way banks report Capital Numbers for Basel regulations. Using Machine Learning (ML) and Natural Language Generation (NLG), this tool automates commentary on variances in Exposure At Default (EAD) and Risk Weighted Assets (RWA) minimizing manual effort, enhancing accuracy, and providing crucial insights for financial strategizing.

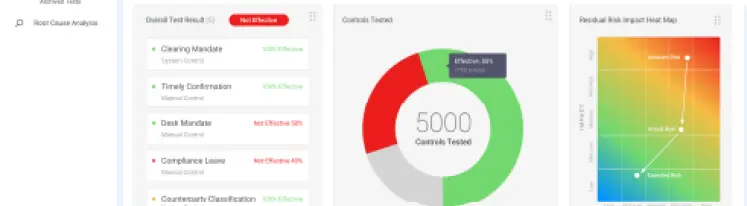

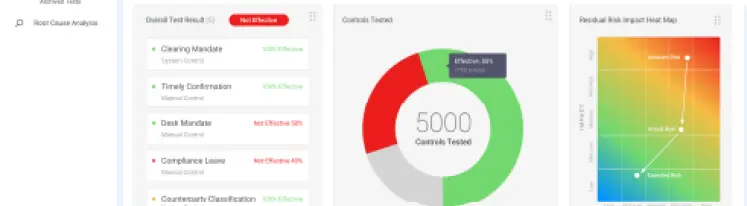

Simplifies the complexity of control environments and automates the labor-intensive process of control testing, allowing Boards and Executives to answer critical risk management questions swiftly and accurately. Transitions the First Line of Defense from testing to enhancing control frameworks, using Robotic Process Automation (RPA) and data science technologies.

Tackles the challenges of IFRS 9 and US GAAP compliance for banks operating internationally. Simplifies the consolidation of expected loss calculations and supports real-time, detailed financial analysis. Flexible architecture integrates seamlessly with existing risk models, enhancing reporting accuracy and risk assessment.

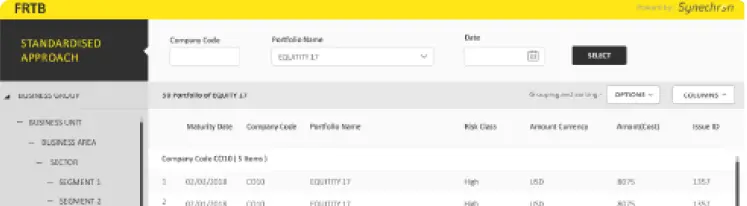

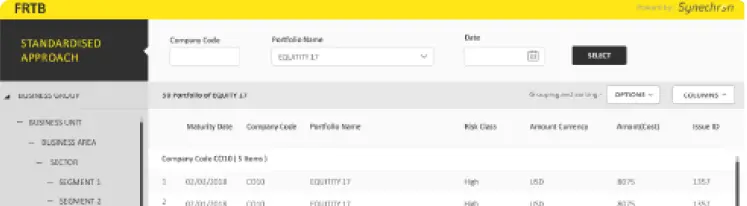

Addresses the sweeping changes introduced by FRTB regulations. Overhauls traditional system architectures, integrating advanced data processing and management to meet new regulatory requirements. It offers a comprehensive workflow for identifying and grouping risk sensitivities, calculating sensitivity-based risk charges, and enhancing risk calculations at the desk level.

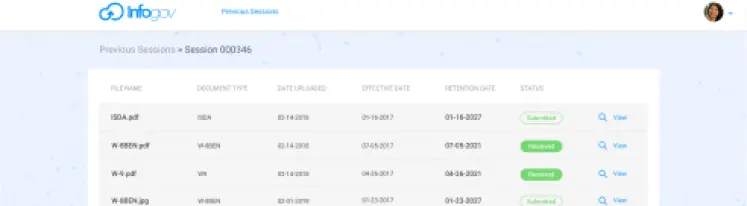

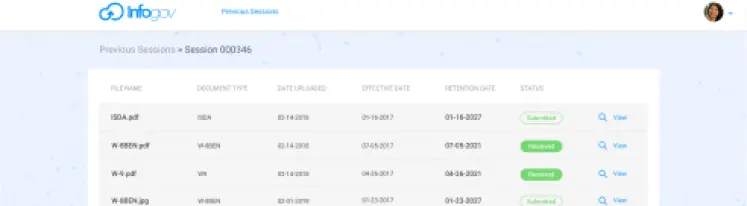

Helps manage unstructured data and adheres to complex record-keeping regulations. It automates the analysis, classification, and retention of documents reducing the risk of regulatory fines for inadequate records management. Employs OCR and NLP to process a wide range of unstructured documents, ensuring compliance with multiple regulations and enabling efficient document management.

Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Japan

Japan  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Serbia

Serbia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States