Serbia EN

Serbia EN Serbia EN

Serbia ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the interconnected digital ecosystem.

Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Co-implement your digital products and services

Deploy cutting edge technology-driven solutions for current manually-intensive cohesive partnering with other service/product providers using APIs and Data Science components through a digitally-connected ecosystem.

Build proprietary customer profiles, foster greater customer engagement and provide expanded services through implementation of an array of targeted products/services offered as part of a network of key co-participants and top-notch firms through digital integration.

Automate, improve and expand vital Treasury services across cash management liquidity, data aggregation and reporting upgrades via Open Banking, as well as automate Margin Call services using RPA, NLP over a cyber-secure, encrypted channel.

Speed digital transformation for enhanced financial desktop user experiences and easier communication between programs with browser-agnostic flexibility and mobility, frequent OS updates, and instant app installation.

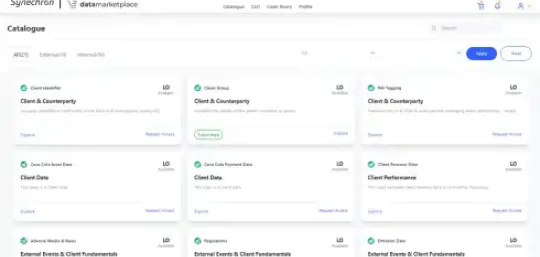

Deploy cutting edge technology-driven solutions for current manually-intensive cohesive partnering with other service/product providers using APIs and Data Science components through a digitally-connected ecosystem.

Build proprietary customer profiles, foster greater customer engagement and provide expanded services through implementation of an array of targeted products/services offered as part of a network of key co-participants and top-notch firms through digital integration.

Automate, improve and expand vital Treasury services across cash management liquidity, data aggregation and reporting upgrades via Open Banking, as well as automate Margin Call services using RPA, NLP over a cyber-secure, encrypted channel.

Speed digital transformation for enhanced financial desktop user experiences and easier communication between programs with browser-agnostic flexibility and mobility, frequent OS updates, and instant app installation.

Provides a unified, shared digital platform across a network of homeowner-related distributed participants – banks, insurers, utility companies, security and service firms -- to produce shared value-added services across a variety of financial and non-financial needs, throughout the home ownership lifecycle.

Enables investors to generate end-user configured stranded asset risk scenarios to simulate the future stock price impact of a low-carbon transition economy. Users will be able to identify alpha-generating possibilities that align with their impact investment objectives.

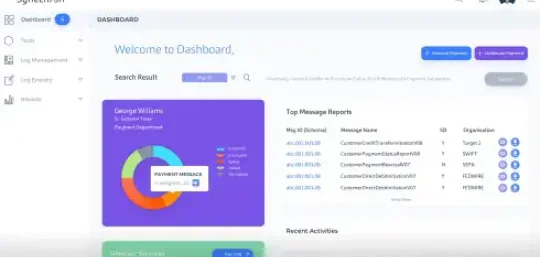

An API-enabled, secure, closed-based Ecosystem automates the bank's Treasury, liquidity, and cash management tasks across several, segmented departments within a business division. This enables banks to create "Treasury-as-a-Service" (TaaS) platforms for clients, resulting in the creation of a new revenue-generating business model.

The Margin Call Automation Network on Symphony is a workflow, dual bots engine developed on top of the secure inter-firm communications platform for automated margin call management with fit-for-purpose infrastructure across the middle office.

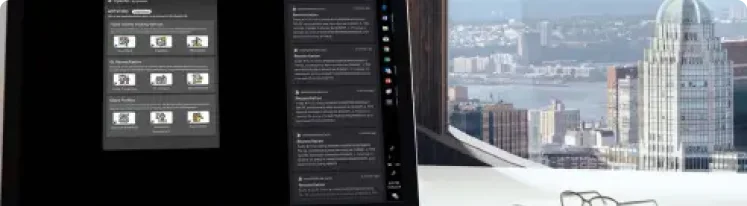

Synechron’s Smart Desktop Interoperability on OpenFin Accelerator provides a framework for accelerating enterprise-scale digital transformation across business applications. The Accelerator uses four of Synechron’s Wealth Tech Accelerator applications that are siloed, unconnected solutions. This accelerator uses OpenFin to quickly bridge across these complementary apps to mimic a potential user’s Ecosystem.

Global

Global  Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Japan

Japan  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States