Serbia EN

Serbia EN Serbia EN

Serbia ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the data realm.

Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformations. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Let your data work for you

Explore and implement key strategies to monetize your data through new technologies, techniques and evolving services that will develop new revenue-building products/services and business channel enhancements. Transform your data into useable intelligence that will greatly benefit your customers.

Enhance advanced data-driven service and product offerings to clients in areas of Asset Management, Merchant Services, Retirement Advisory and Transaction Fraud through future-looking solutions. Become the business provider of choice for your clients whom they turn to for value-added innovations.

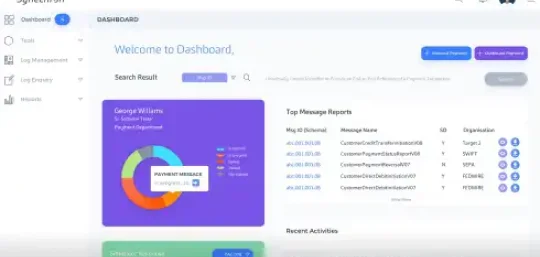

Identify, collect and anonymize Transaction fraud reports, then share them as operational intelligence with other banks and regulators. Generate an additional revenue stream by sharing fraud data on subscription basis with other banks, all while thwarting similar fraudulent activity in the market.

Fill individual retirement planning gaps with personalized, self-service tools that inspire discussions of goals, spending, saving and ‘what if’ scenarios. Customizable interfaces, plus forecasting and predictive analysis, create Financial Wellness awareness and enhance Retirement Advisors’ role.

Explore and implement key strategies to monetize your data through new technologies, techniques and evolving services that will develop new revenue-building products/services and business channel enhancements. Transform your data into useable intelligence that will greatly benefit your customers.

Enhance advanced data-driven service and product offerings to clients in areas of Asset Management, Merchant Services, Retirement Advisory and Transaction Fraud through future-looking solutions. Become the business provider of choice for your clients whom they turn to for value-added innovations.

Identify, collect and anonymize Transaction fraud reports, then share them as operational intelligence with other banks and regulators. Generate an additional revenue stream by sharing fraud data on subscription basis with other banks, all while thwarting similar fraudulent activity in the market.

Fill individual retirement planning gaps with personalized, self-service tools that inspire discussions of goals, spending, saving and ‘what if’ scenarios. Customizable interfaces, plus forecasting and predictive analysis, create Financial Wellness awareness and enhance Retirement Advisors’ role.

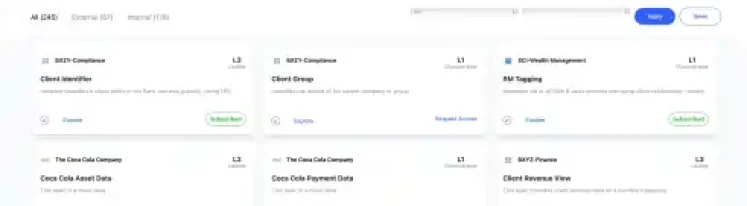

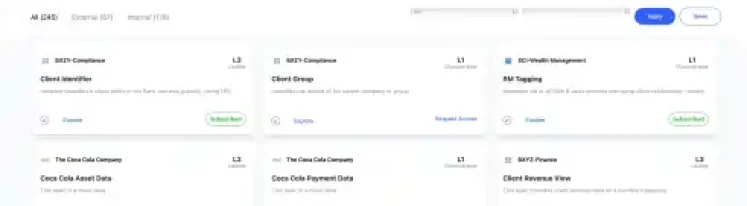

A platform enabling banks and financial institutions, together with their clients and partners, to explore internal & external data and shop for important data via a data-assets-as-a-service paid offering. Data is then loaded into a spun-up cloud-hosted clean room to derive enhanced insights for clients’ portfolio analytics models, with all rooms wiped clean after use.

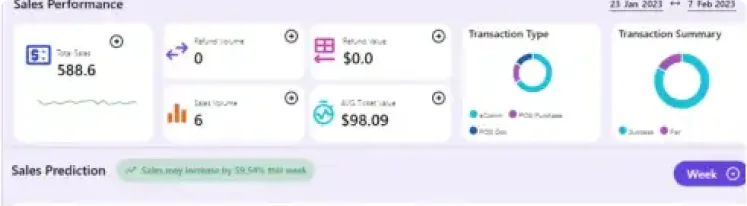

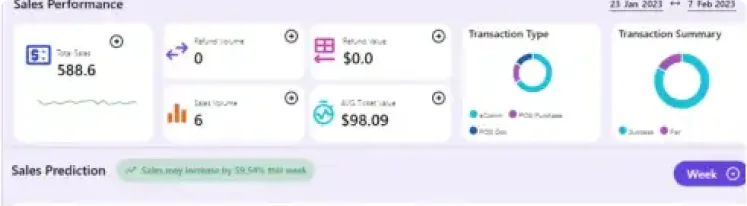

A program enabling banks and Payment Processors to provide to their Merchant clients key, customized market insights and business intelligence about their consumers’ spending trends, buying preferences, shopping locations and more, based on payment data. Data-driven actionable views enable development of highly customized offerings to Merchant clients.

A subscription-based tool for banks and other financial services organizations to share ingested, collected and summarized fraud cases, incident reports and fraudulent activities in near-real time with other banks, organizations and regulators. Fraud data is monetized while proactively working to prevent similar future fraud incidents/ scammers.

Facilitates retirement plan and wealth advisors to better guide retirement plan participants and individuals with a self-service client tool to enhance personalized discussions about future retirement goals, needs and scenarios. The customizable, interactive application includes predictive analytics and future financial forecasting to enable deeper interactions, recommendations and suggestions for accumulation/spending.

Global

Global  Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Japan

Japan  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States