Serbia EN

Serbia EN Serbia EN

Serbia ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the Advanced Data Analytics realm.

Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Leverage AI data science platforms, strategies & tools

Utilize sophisticated AI, and varied Data Science-enabled tools to automate key investment-related processes, banish manually-intensive tasks and decrease the risk of human errors.

Ingest critical but diversely located structured/unstructured company data, market sentiment, macro-economic, portfolio and client data to produce enhanced business intelligence for better investment decisions and choices.

Use sophisticated AI and Data Science-led tools and strategies to enable wealth managers and investment advisors to up their game and create, customize, tailor and adjust portfolios based upon deeper insights and informed predictions.

Embrace modern portfolio/wealth management strategies, platforms and tools to potentially produce better results and mitigate risks. Stay ahead of the same-old portfolio management ways and drive more client engagement, happiness and ‘stickiness’.

Utilize sophisticated AI, and varied Data Science-enabled tools to automate key investment-related processes, banish manually-intensive tasks and decrease the risk of human errors.

Ingest critical but diversely located structured/unstructured company data, market sentiment, macro-economic, portfolio and client data to produce enhanced business intelligence for better investment decisions and choices.

Use sophisticated AI and Data Science-led tools and strategies to enable wealth managers and investment advisors to up their game and create, customize, tailor and adjust portfolios based upon deeper insights and informed predictions.

Embrace modern portfolio/wealth management strategies, platforms and tools to potentially produce better results and mitigate risks. Stay ahead of the same-old portfolio management ways and drive more client engagement, happiness and ‘stickiness’.

Synechron’ AI Data Science Accelerator includes two powerful data science platforms that can accommodate a variety of data-focused strategies and methodologies. The Syn-AI for Signal Discovery platform ingests large volumes of structured and unstructured data.

Our second AI Data Science-led research application/platform, Granger Causality, frees the investment researcher to focus on analysis, versus data acquisition, transformation, and presentation. It retrieves, transforms and analyzes dozens of real-time and historical data sets as an ad hoc research analysis tool with the click of a button.

Our Visual Research tool uses a combination of Data Science, AI, and ML tools and techniques to produce robust, insightful, and cost-effective investment research, including deploying Synechron’s Syn-AI Signal Discovery analysis platform.

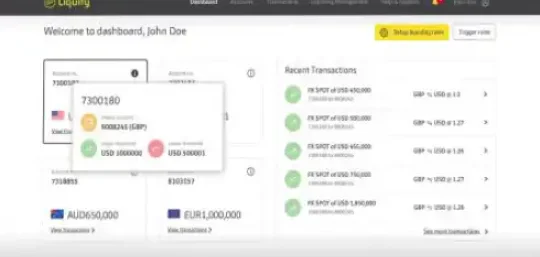

Informed Investing provides investment advisors/wealth managers with a powerful platform for analyzing client portfolios and proactively engaging clients and prospects with insights not available with traditional investment and research tools.

The Credit Risk tool empower banks to proactively manage their credit portfolios, whether they consist of mortgages, auto loans, credit card loans, or business loans. By ingesting historical loan, macroeconomic, and borrower data, the accelerator uses ML models including clustering algorithms, and neural networks to predict credit defaults, delinquencies, and prepayments.

Our AI-empowered Customer Complaints Management accelerator empowers banks to fully automate and proactively manage customer complaints. It sits on top of proprietary CRM platforms or other sources of consumer complaints data, and deploys Data Science tools to list, analyze and prioritize customer complaints.

The LIBOR Impact Analysis accelerator digitizes a bank’s LIBOR-sensitive assets and uses the latest advancements in NLP to extract the fields and values required for valuation / exposure calculations from unstructured contract text. It enables financial institutions to flexibly and accurately quantify the impact of LIBOR index-linked contracts across asset classes and business units, so the expiring LIBOR can be best replaced.

Global

Global  Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Japan

Japan  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States