Japan EN

Japan EN Japan EN

Japan ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the blockchain realm.

Synechron's proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand our client's most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Solve real-world operational problems

Achieve significant savings by automating manual operations -- calls, emails, and paperwork. Eliminates redundant tasks and processing costs while minimizing human error. Uses digital currencies for payment transfers to slash third-party fees.

Secure transactions with blockchain technology. Its tamperproof nature, backed by a consensus-driven database, ensures no single party can alter transaction records. Enhances security and reliability of the transaction chain.

Foster trust and accuracy in transactions with shared access and validation. Blockchain’s uniform view for all network users eliminates the risk of duplicative uses or expenditure, ensuring absolute transparency in every transaction.

Leverage blockchain to remove intermediaries, creating direct, more efficient settlement relationships. Speed up cycle time, streamline workflows, and reduce paper processing.

Achieve significant savings by automating manual operations -- calls, emails, and paperwork. Eliminates redundant tasks and processing costs while minimizing human error. Uses digital currencies for payment transfers to slash third-party fees.

Secure transactions with blockchain technology. Its tamperproof nature, backed by a consensus-driven database, ensures no single party can alter transaction records. Enhances security and reliability of the transaction chain.

Foster trust and accuracy in transactions with shared access and validation. Blockchain’s uniform view for all network users eliminates the risk of duplicative uses or expenditure, ensuring absolute transparency in every transaction.

Leverage blockchain to remove intermediaries, creating direct, more efficient settlement relationships. Speed up cycle time, streamline workflows, and reduce paper processing.

Provides a working usable code and a private blockchain infrastructure to reduce trade finance risks, fraud and processing costs across the entire international trade finance system. It digitizes workflows for the highly-decentralized, paper contract-intensive, payments-based market of large banks, and provides a common workflow for all participants – banks, suppliers, buyers, credit rating agencies and shipping providers.

Leverages blockchain technology to streamline the whole mortgage value chain – from application to closing – significantly enhancing efficiency and transparency. Addresses key industry challenges: Prolonged transaction times, varying lending criteria, and cumbersome due diligence processes. Reduces operational costs and errors for financial institutions and improves the overall customer mortgage experience.

Addresses the complexities of liquidity risk/collateral management of strict global regulations. Streamlines the margin call process in OTC derivative contracts – greatly reducing the time and costs associated with manual interventions. Embeds transaction valuation logic in smart contracts via a customizable Hyperledger Fabric private blockchain network to ensure efficient, error-free, and unanimous completion of margin calls.

Automates and objectifies claims validation, assessment, and payment – drastically reducing manual intervention. Creates a transparent/trusted environment for customers, insurers, and regulators, addressing inefficiencies and subjective biases of current practices. Uses smart contracts and authoritative data sources to streamline the full process, thereby reducing operational costs and fraud risks.

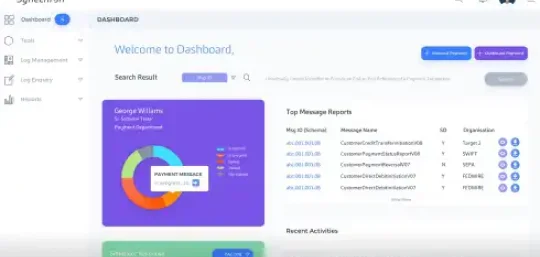

Blockchain-based payments system addresses the high costs and inefficiencies of traditional payment systems. Eliminates intermediaries and optimizes foreign-exchange rates. Instantaneous settlement, complete transaction tracking, and compliance with regulatory standards are key features. Enables a bank’s corporate/consumer customers to make transfers and review transactions.

Transforms the KYC process for banks, leveraging blockchain technology to securely and efficiently manage client data. Streamlines the end-to-end client interaction, allowing banks to regain ownership and control. Enhances compliance and operational efficiency by automating KYC and anti-money laundering (AML) controls through smart contracts and centralizing risk assessments.

Global

Global  Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Serbia

Serbia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States