Japan EN

Japan EN Japan EN

Japan ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the payments realm.

Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Evolve your payment systems journey

Keep up with necessary payments industry changing messaging standards, increase financial institutions interoperability, and ensure future regulatory compliance by field testing, validating and migrating your financial messaging operations.

Explore and build new payments-centric products and services for clients in the shifting and increasingly competitive payments landscape. A BNPL digital solution with data science features to help banks create a new revenue stream by offering alternate lending.

Flag and fight ever-increasingly sophisticated and shifting cyberattacks and fraud threats by deploying modern strategies, analytics and discovery tools to rapidly assess and kill even unknowing Black Swan fraud attempts in real time.

Enhance key services to new and existing large corporate clients’ Group Treasury functions to provide better cash management, metrics visibility and predictive analysis, along with expanded FX and risk management, on your way to becoming the bank of choice for your expanding client base.

Keep up with necessary payments industry changing messaging standards, increase financial institutions interoperability, and ensure future regulatory compliance by field testing, validating and migrating your financial messaging operations.

Explore and build new payments-centric products and services for clients in the shifting and increasingly competitive payments landscape. A BNPL digital solution with data science features to help banks create a new revenue stream by offering alternate lending.

Flag and fight ever-increasingly sophisticated and shifting cyberattacks and fraud threats by deploying modern strategies, analytics and discovery tools to rapidly assess and kill even unknowing Black Swan fraud attempts in real time.

Enhance key services to new and existing large corporate clients’ Group Treasury functions to provide better cash management, metrics visibility and predictive analysis, along with expanded FX and risk management, on your way to becoming the bank of choice for your expanding client base.

A system providing financial institutions with the ability to generate test data, verification and reporting support to enable compliance with new, de facto ISO 20022 XML-based international financial messaging standards. End-to-end support allows for either a ‘Big Bang’ or a multi-step migration to the new messaging standards.

Our ‘Buy Now Pay Later’ solution enables banks to rapidly customize their own omni-channel alternative lending platform. A frictionless, point-of-sale customer onboarding experience coupled with an intelligent and customizable credit decisioning engine that can help banks offer credit in real-time.

An automated, continuous system for monitoring omni-channel and omni-banks for cybersecurity threats and account fraud based on real-time transactions, non-financial events and behaviors within the bank, including unknowable massive Black Swan attacks. A bank’s security ops team is enabled with an intelligent kill switch.

A next-generation, real-time cash management tool that enables the Corporate Treasurer of a multi banked and multi-national corporation to better manage inflows/outflows, buffers, and currencies across global operating units.

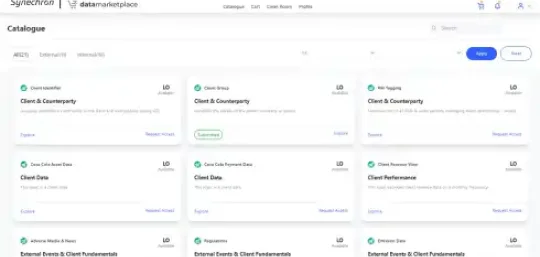

A cloud-based, advanced data platform that consists of state-of-the-art data and intelligence features that help tackle key challenges of banks to developing digital payments solutions.

Global

Global  Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Serbia

Serbia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States