Japan EN

Japan EN Japan EN

Japan ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the AI automation realm.

Synechron's proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand client's most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Dramatically enhance business operations

Harness the power of Cognitive ML and NLP/NLG/ML to accelerate deep financial analysis and forecasting. Gain access to unparalleled insights into market trends, liquidity management, and asset allocation to stay ahead in a rapidly evolving financial landscape.

Implement cutting-edge AI and NLP technologies to transform customer experiences. Offer intuitive, personalized customer service and financial guidance. Enhance customer satisfaction and open new avenues for engaging with diverse clients.

Leverage advanced automation tools to streamline operations. Enhance efficiency, reduce human error, and enable allocations of resources to more pressing tasks. Utilize AI automation to forecast future market trends and customer behaviors — revealing patterns and insights that inform strategic business decisions.

Use Robo-Advisors and ML solutions to provide sophisticated, data-driven investment decisions. Democratize financial advisory services, making them accessible to a wider audience while also offering personalized, high-touch experiences. Cater to a broader market spectrum with varying levels of investment expertise.

Harness the power of Cognitive ML and NLP/NLG/ML to accelerate deep financial analysis and forecasting. Gain access to unparalleled insights into market trends, liquidity management, and asset allocation to stay ahead in a rapidly evolving financial landscape.

Implement cutting-edge AI and NLP technologies to transform customer experiences. Offer intuitive, personalized customer service and financial guidance. Enhance customer satisfaction and open new avenues for engaging with diverse clients.

Leverage advanced automation tools to streamline operations. Enhance efficiency, reduce human error, and enable allocations of resources to more pressing tasks. Utilize AI automation to forecast future market trends and customer behaviors — revealing patterns and insights that inform strategic business decisions.

Use Robo-Advisors and ML solutions to provide sophisticated, data-driven investment decisions. Democratize financial advisory services, making them accessible to a wider audience while also offering personalized, high-touch experiences. Cater to a broader market spectrum with varying levels of investment expertise.

Leverages AI to understand written/spoken human language, as well as extract/analyze/convert composite data sets, and automate complex tasks for trading analysis and reporting. Balances technology and human intervention for extracting data from corporate reports to feed analysis, increase accuracy, and standardize operations.

Brings the precision of robotics to the financial sector. Combines RPA with advanced AI technologies such as Optical Character Recognition (OCR) and NLP/NLG to automate manual tasks and optimize processes. Strengthens compliance, accuracy, and customer experience. Integrates varied tech frameworks to ensure alignment with business strategies and regulatory requirements.

Tackles the complexities of financial data analysis and predictions. Advanced machine learning (ML) techniques, combined with NLP, address intricate liquidity, pricing, and risk management challenges in financial institutions. Streamlines intra-day liquidity calculations, enhances data collection and analysis, and significantly improves the predictability and reliability of financial data.

Leverages data science methods to transform vast amounts of structured and unstructured data into actionable insights. Advanced techniques like ML, predictive analysis, and NLP provide customer insights, product recommendations, and combat financial fraud/ money laundering. Enables analysis of data patterns, development of customer programs, and data-driven decision-making. Addresses challenges in mortgage default risk, AML, and fraud detection.

Enhances customer engagement for banking, insurance, investments, and loan services. The omnichannel Application Programming Interface (API) integrates seamlessly across various channels for a comprehensive chatbot service. Combines AI, NLP, and ML to provide personalized and efficient existing/prospective customer experiences, or employee support. Enables secure transactions, product onboarding, and access to information.

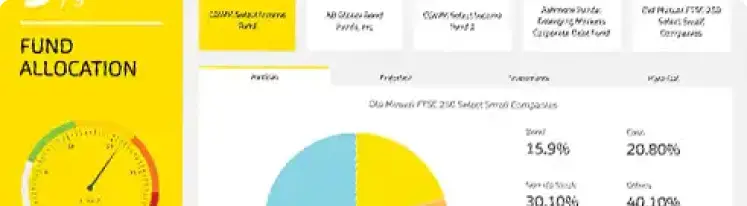

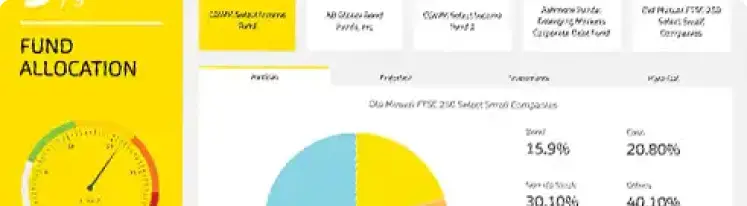

RoboInvestor™ uses sophisticated algorithms for a fully- or assisted-automation platform for customized asset allocation, investment/portfolio management, tax/retirement, and estate planning for financial/wealth advisors and clients. Bridges the gap between traditional financial advisory services and modern technology, making wealth management accessible to a broad audience.

Global

Global  Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Serbia

Serbia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States