Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Co-implement your digital products and services

Deploy cutting edge technology-driven solutions for current manually-intensive cohesive partnering with other service/product providers using APIs and Data Science components through a digitally-connected ecosystem.

Build proprietary customer profiles, foster greater customer engagement and provide expanded services through implementation of an array of targeted products/services offered as part of a network of key co-participants and top-notch firms through digital integration.

Automate, improve and expand vital Treasury services across cash management liquidity, data aggregation and reporting upgrades via Open Banking, as well as automate Margin Call services using RPA, NLP over a cyber-secure, encrypted channel.

Speed digital transformation for enhanced financial desktop user experiences and easier communication between programs with browser-agnostic flexibility and mobility, frequent OS updates, and instant app installation.

Combining human and AI creativity, our suite of AI products streamlines services, and provides insights and efficiencies to business at scale. Synechron Nexus encompass three value streams:

Business Growth to Ignite Innovation

AI powered innovative and practical applications that augment human capabilities and enhance client operations.

Operational Efficiency to Elevate Excellence

AI operational efficiency solutions to streamline processes, reduce manual intervention and costs and boost quality.

Developer Productivity to Accelerate Development Speed and Efficiency

Optimizing project timelines and minimizing deployment costs through automated test generation and efficient development practices.

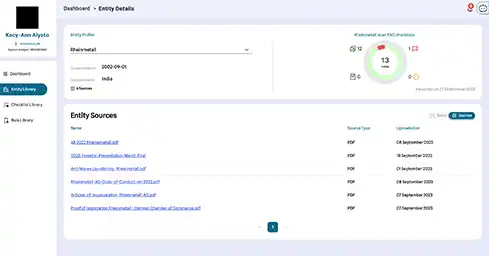

Artificial Intelligence-enhanced solutions designed to automate and boost efficiencies of processes for better risk identification, management and mitigation across five critical and impactful business areas: supply chain, climate, regulatory implementation, KYC, and IT/cybersecurity risks.

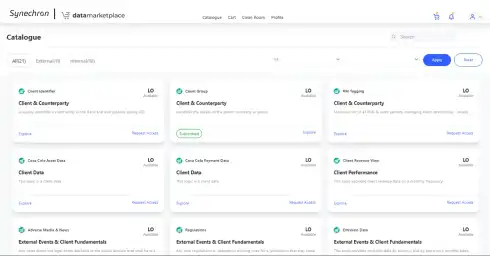

Advanced data solutions that solve key challenges in the areas of data availability, privacy, sharing, quality, and useability to help financial institutions monetize their business data to realize tremendous value – develop new revenue streams, enable efficiencies at scale, and achieve novel market positioning.