United States EN

United States EN United States EN

United States ENAron Kalsbleek

Associate Director - Finance & Risk Transformation Practice , The Netherlands

Data

Every transformation program involves 3 key steps prior to execution: defining the target state vision, assessing the current state and drawing the solution roadmap to achieve the target state. The solution roadmap is required to cover all aspects of the problems identified in the current state assessment exercise. While many solutions have been broadly tried with their own merits and demerits, TOGAF has proven itself to be holistic especially for the banking domain, with a possibility of tailoring and adapting to the specific needs and areas of improvement for each organization. On that note, we would like to further dive into the various TOGAF pillars, key best practices with maximum impact from our experience, and how they address the key challenges faced within the F&R domain.

The Open Group Architecture Framework (TOGAF) is an overarching approach to design, plan, implement, and govern an enterprise information architecture. TOGAF is the global standard for developing an enterprise information architecture and, therefore, it provides an extensive outline of all the aspects to consider to structurally improve the Finance & Risk function. TOGAF ensures that the Finance & Risk transformation starts with agreeing on the strategic objectives and that, subsequently, all relevant dimensions are considered during development and realization. At many banks, the Finance & Risk strategic objectives come down to being more effectively in control (over data) and, preferably, at a lower cost.

Synechron advocates using the TOGAF framework for the following main reasons (non-exhaustive list):

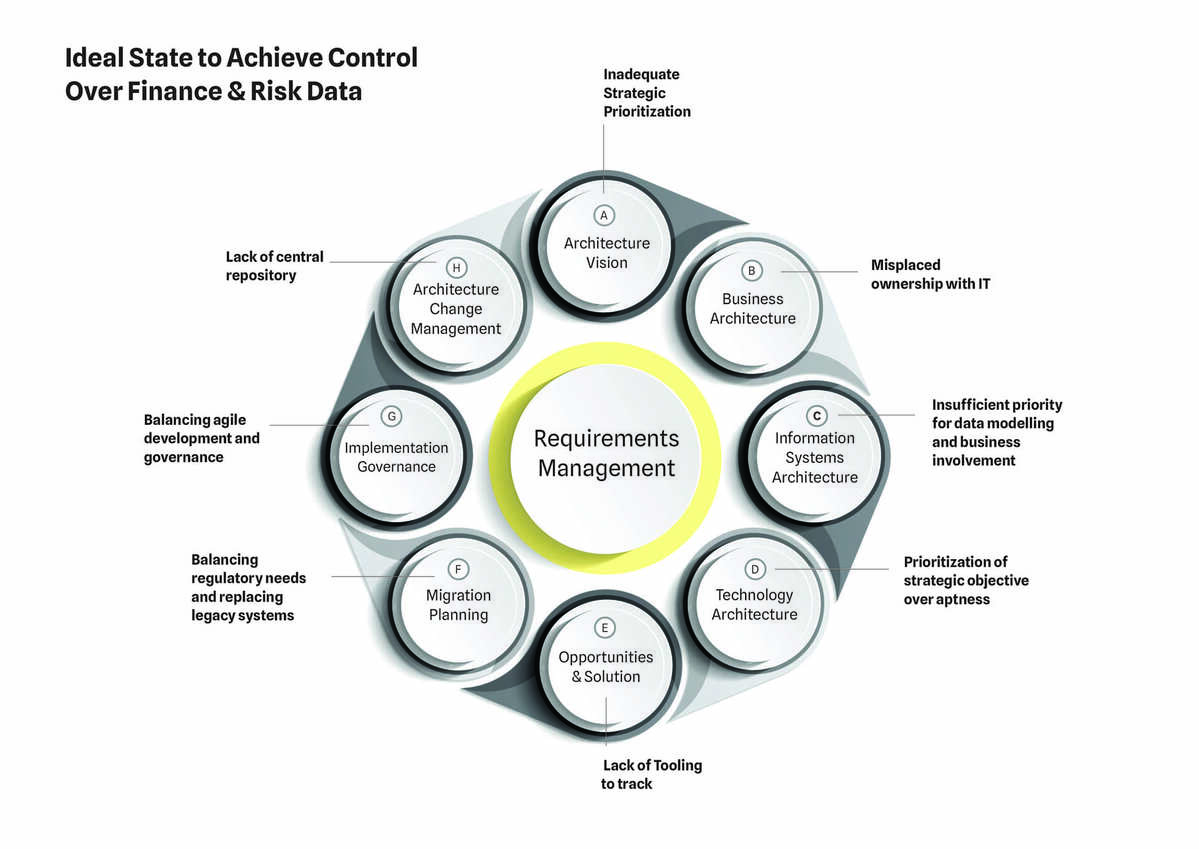

At the center of the TOGAF framework lies the Architecture Development Method (ADM). The ADM is a structured iterative process of nine phases describing the development cycle of an enterprise information architecture. From experience and best practices, the ADM can be best broken down into four categories.

Category: ‘Strategy & Motivation’--Defining the strategic drivers that specify your ambitions:

Category: ‘Baseline vs. Target Design’-- Designing the target state consistently across multiple dimensions (also known as a Target Operating Model) and describing the differences with the baseline (as-is) state. The design is created in the following phases:

Category: ‘Transformation roadmap’-- Defining an integrated roadmap bringing together all the needed parts in the chain needed to successfully transform the Finance & Risk function.

Category: ‘Transformation Governance’-- Set-up a proper transformation governance involving all parties in the chain required to realize the change:

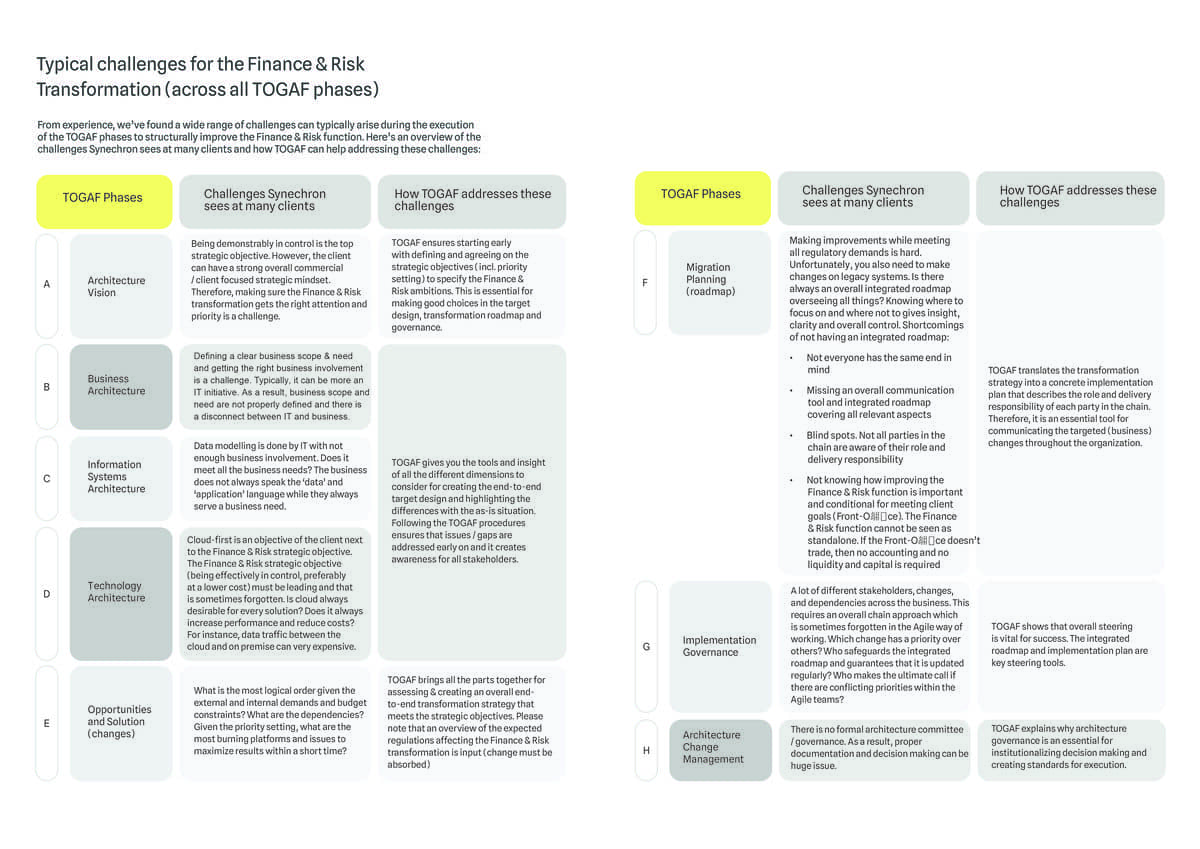

From experience, we’ve found a wide range of challenges can typically arise during the execution of the TOGAF phases to structurally improve the Finance & Risk function. Here’s an overview of the challenges Synechron sees at many clients and how TOGAF can help addressing these challenges:

Synechron advocates using the TOGAF framework tailored to your needs to structurally improve the Finance & Risk function and be more effectively in control. TOGAF is a holistic framework that guarantees all aspects are covered. Combining TOGAF with best practices to tackle the wide range of challenges, makes it possible to support and advance the Finance & Risk transformation. Each Finance & Risk transformation is unique and, therefore, each Finance & Risk information architecture Synechron helps create differs in the level of detail and complexity. Ultimately, Finance & Risk information architecture derives its value by being an agreed ‘contract’ between all the stakeholders in the chain involved. It gives overall direction, insight, and control to successfully improve the Finance & Risk function.

At Synechron we are more than happy to explain how your organization can benefit from our experience in (re)designing processes. Over the years from our Finance & Risk, and Enterprise Architecture practices, we have helped numerous clients with the change to more resilient reporting processes and tighter data control.