Japan EN

Japan EN Japan EN

Japan ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in InsurTech.

Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Provide the best insurance solutions and experiences to your customers

Design your digital-first business model by boosting customer engagement. Offer services beyond traditional risk protection by enabling data and deploying new technologies.

Analyze customer and claims data and develop new propositions around smart usage insights. Leverage this data for internal purposes such as risk management, price optimization and fraud analytics to boost data driven decision-making.

Redesign your insurance operations from a customer-centric perspective. Utilize smart technology to carry out complicated insurance tasks in addition to simple transactions, resulting in smooth, cross-channel interactions and maximum self-service.

Reduce reliance on manual labor and cut costs by up to 40% across the claims handling system. We also foresee a sizable decline in fraud and higher-quality gains from increased customer trust relationships.

Design your digital-first business model by boosting customer engagement. Offer services beyond traditional risk protection by enabling data and deploying new technologies.

Analyze customer and claims data and develop new propositions around smart usage insights. Leverage this data for internal purposes such as risk management, price optimization and fraud analytics to boost data driven decision-making.

Redesign your insurance operations from a customer-centric perspective. Utilize smart technology to carry out complicated insurance tasks in addition to simple transactions, resulting in smooth, cross-channel interactions and maximum self-service.

Reduce reliance on manual labor and cut costs by up to 40% across the claims handling system. We also foresee a sizable decline in fraud and higher-quality gains from increased customer trust relationships.

Our Blockchain tools are focused on two use cases. Insurance Claims Processing makes use of Blockchain's Distributed Ledger Technology (DLT), smart contracts, and digital capabilities. The Trade Finance Accelerator connects banks and insurance corporations on a single Distributed Ledger to reduce fraud and promote transparency throughout the supply chain.

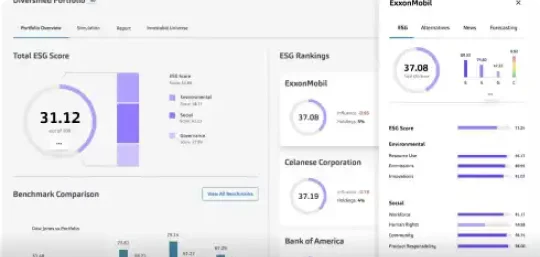

Synechron's Cognitive Machine Learning AI solutions combine in-depth understanding of data mapping and financial operations with sophisticated data analysis to perform difficult calculations and computations. Automate data extraction, manage underwriting scoring, and implement a Visual Risk System for efficiency.

Synechron's RPA solutions enable financial service firms to integrate Optical Character Recognition (OCR) and Natural Language Processing (NLP) into a single engine capable of understanding content, context, and applying business rules to heighten operations and productivity through robotics.

Combines our comprehensive understanding and experience in insurance products/services with a digital strategy for custom mobile application development. Enables extensive collaboration with insurance firms to provide a selection of major applications that prioritize and optimize customer experience.

Customer interactions, including insurance chatbot services, are key. Insurance firms are adapting their business procedures for digital-first initiatives. This can be accomplished through intelligent agents such as insurance chatbots (e.g., InsureBOT or InspectionBOT), user experience design for Direct-to-Consumer Strategy applications, or commercialized broker experiences.

The Internet of Things (IoT) for insurance is all about ensuring real-time, authoritative data sources for improved risk management. Data becomes more potent when paired with cutting-edge technologies like Blockchain to help with difficulties like asset attribution or AI approaches as a data source.

Global

Global  Australia

Australia  Canada

Canada  Canada

Canada  France

France  Hong Kong

Hong Kong  India

India  Luxembourg

Luxembourg  Saudi Arabia

Saudi Arabia  Serbia

Serbia  Singapore

Singapore  Switzerland

Switzerland  The Netherlands

The Netherlands  United Arab Emirates

United Arab Emirates  United Kingdom

United Kingdom  United States

United States