Hong Kong EN

Hong Kong EN Hong Kong EN

Hong Kong ENDavid Sewell

Chief Technology Officer , Synechron

Consulting

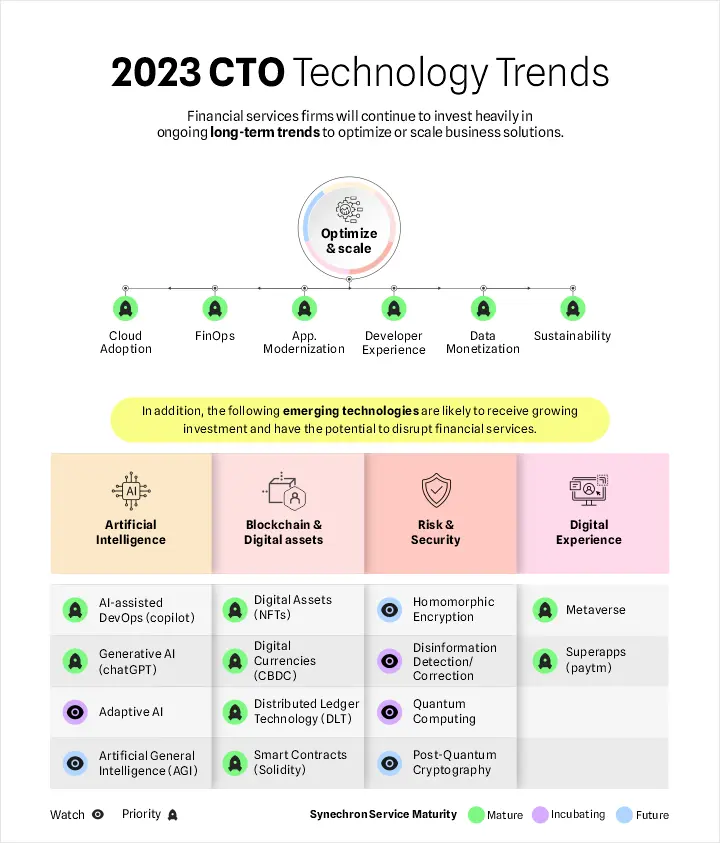

As we dive deeper into the second half of 2023, some emerging technology trends and strategies are ready to have their (much-earned) moment in the spotlight and be implemented to the benefit of financial services firms’ operations.

We believe four groups of identifiable emerging technologies are quite likely to receive growing investment allocations from financial services firms. These have the potential to significantly disrupt the financial services industry, and clearly demonstrate their array of positive benefits.

Here’s a look at what Chief Information Officers, Chief Technology Officers, Business Unit Heads and various other stakeholders will want to focus their energies on: