United Kingdom EN

United Kingdom EN United Kingdom EN

United Kingdom ENOur FinLabs create and test innovative solutions to best position our clients for their present and future business needs. We are here to prepare you for what’s to come in the Wealth Management Domain.

Synechron’s proprietary FinLabs serve as innovation hubs. We invest the time and conduct the research necessary to understand clients’ most pressing business challenges. Our experts then strategize cutting-edge technologies to solve these challenges.

We promote innovative ways to drive business efficiencies, support enhanced operations and accelerate their digital transformation. We ideate, engineer, and implement operational platforms, digital applications, and data science tools to empower the businesses we work with.

Stay ahead of the game in your Wealth Management division

Develop potent new solutions and produce well-informed investment plans by combining Artificial Intelligence, sentiment analysis, client behavioral targeting, historical data analysis, predictive analytics, and other strategies.

Offer new digital experiences to clients through gamification, augmented reality (AR) and virtual reality (VR), smart investor portals, engaging dashboards, transparent and personalized solutions, and enhanced automation.

Establish a transaction-generated fee structure and improve advisor incentivization. Evaluate the potential impact of fee changes vs. the likelihood of a positive or negative client relationship outcome. Offer transparency, benchmarking, and insight on advisory fees.

Closely monitor explicit and implicit client behavior and capture variations as regulations and company-specific rules evolve. Reduce compliance costs and prevent costly legal/compliance errors which lead to lawsuits.

Develop potent new solutions and produce well-informed investment plans by combining Artificial Intelligence, sentiment analysis, client behavioral targeting, historical data analysis, predictive analytics, and other strategies.

Offer new digital experiences to clients through gamification, augmented reality (AR) and virtual reality (VR), smart investor portals, engaging dashboards, transparent and personalized solutions, and enhanced automation.

Establish a transaction-generated fee structure and improve advisor incentivization. Evaluate the potential impact of fee changes vs. the likelihood of a positive or negative client relationship outcome. Offer transparency, benchmarking, and insight on advisory fees.

Closely monitor explicit and implicit client behavior and capture variations as regulations and company-specific rules evolve. Reduce compliance costs and prevent costly legal/compliance errors which lead to lawsuits.

Our accelerator for Client Prospecting takes a data-driven approach by using internal and external data sources to identify prospective clients, thereby enhancing the quantity and quality of leads. Enhance your ability to perform client prospecting by leveraging Artificial Intelligence and Data Science analytics to automate the process of identifying high-value leads.

A streamlined, straight through processing (STP) experience where Natural Language Processing (NLP) and Optical Character Recognition (OCR) automatically process the application for a seamless customer experience. This tool uses Artificial Intelligence to assist in determining a document's intent, thereby reducing complexity and increasing efficiency.

Our accelerator for Efficient Suitability builds a complex Rules Engine backed by data analytics, Artificial Intelligence and Machine Learning by leveraging current client profiles, securities characteristics, and internal wealth management rules for adaptive suitability controls.

Our Pricing Insights solution utilizes a data analytics-driven engine to extract the knowledge required to optimize client fee pricing across an organization. This accelerator provides intelligence, benchmarking, and transparency regarding advising fees to support customer protection laws while optimizing returns.

Synechron’s Tokenized Assets Management Platform is a clickable Invision prototype demonstrating the asset management dashboard and the way smart contracts would function in instances such as compliance and asset transfer.

Synechron's modular Asset-backed Coin Offerings platform enables public token issuances with traditional fundraising features not yet accessible in Asset-backed Coin Offerings. It allows issuance for a percentage of coins or tokens in exchange for cryptocurrencies on a permissionless global blockchain.

Our Smart Statements solution gives customers and advisers access to highly customized and interactive statement views, along with an integrated portfolio management toolkit. Deep investment analysis, interactive graphical statements, and personalized insights come together to create a modern and engaging client experience.

Gamify the investment experience between advisors and clients via dynamic portfolio visualization to encourage investors to understand the advantages of disciplined investing. Create a financial journey by answering yes/no questions on financial scenarios, risk analysis, and objectives through integrated analytics. Embark on a personalized, VR-simulated voyage to witness the financial future.

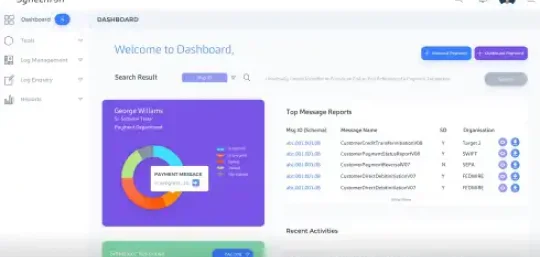

The Relationship Management Dashboard Accelerator is powered by Conversational UI that allows for complete integration across systems and data sources related to key operational interactions with clients. Artificial Intelligence enables investment recommendations via bot. Embrace the future of investment management.