Canada EN

Canada EN Canada EN

Canada EN

Why Transaction Reporting should be on your radar

Transaction Reporting has been under increased regulatory scrutiny by supervisory bodies globally. Over the past decade, financial markets regulators have not shied away from imposing significant fines where market participants were not able to report transactions in a complete, accurate and timely manner.

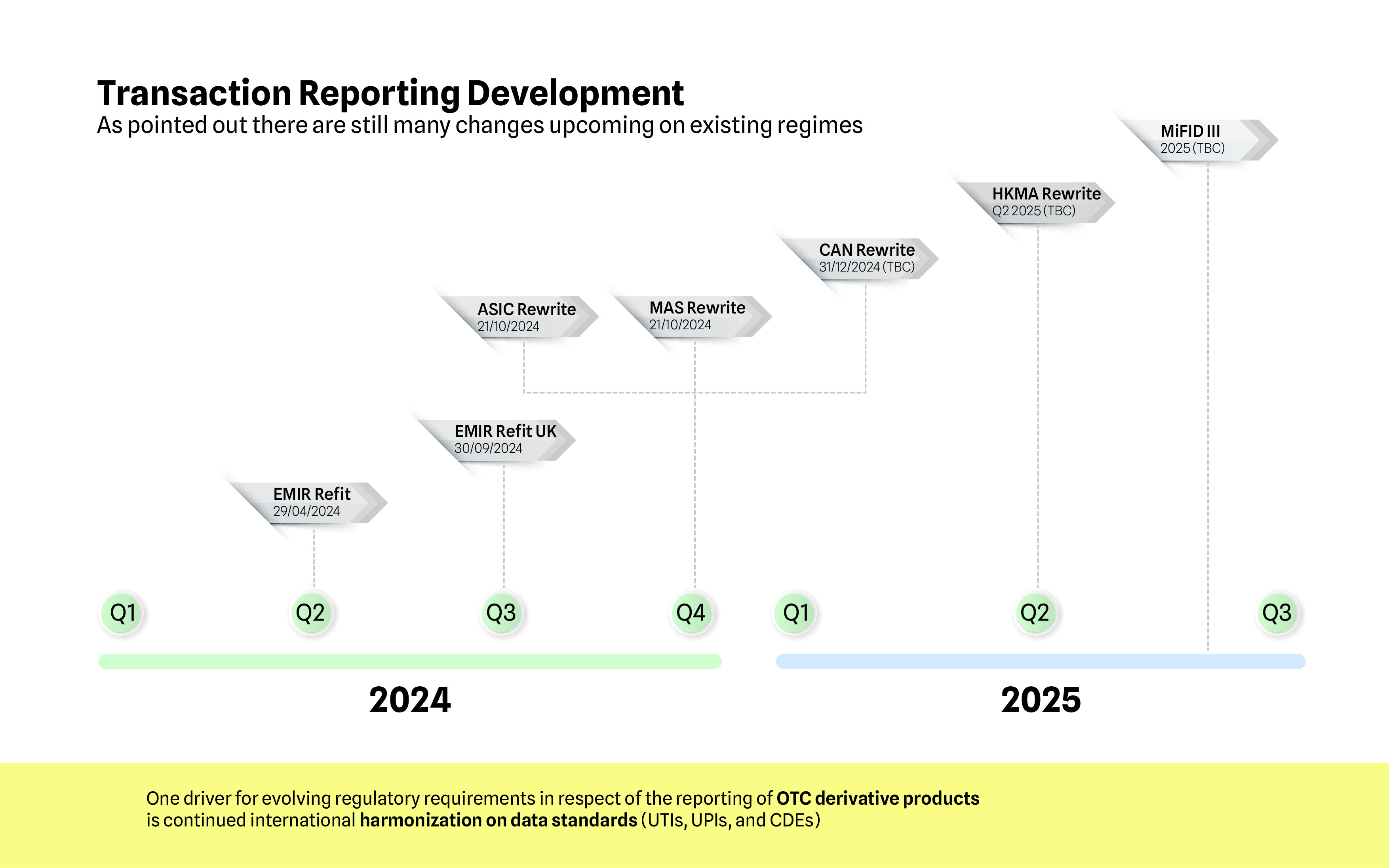

The regulatory Transaction Reporting landscape is complex and keeps evolving. The obligation to track and implement (new and amendments to existing) regulatory reporting requirements on a continuous basis is putting pressure on in-house built reporting solutions. At the same time, organizations are striving for a controlled and efficient Transaction Reporting process.

High data quality is not only a prerequisite for regulatory supervisory bodies to be able to monitor irregular market behavior or identifying risks adequately but also enables market participants to be in control of their transaction reporting.

We combine regulatory expertise with program management and technological capabilities.

Synechron is your key partner of choice to support you with your Transaction Reporting challenges. Our experts can guide your regulatory implementations and can support you in gaining or regaining control over your full Transaction Reporting chain. We will help you to bring your control framework up to the standards the current market desires, while keeping an eye on the efficiency of the full transaction reporting process.

Synechron has extensive experience in guiding and managing regulatory change programs:

Synechron can support improving the quality of your Transaction Reporting:

Synechron can provide technology leadership for the architecture and delivery of the reporting infrastructure based on the latest developments such as NoSQL:

Do you want to work for an ambitious, international, and fast-growing firm? We are looking for new colleagues for our Amsterdam office!

For further information, please contact our recruiter,

Or check out our vacancies here: