India EN

India EN India EN

India EN

Andrew O'Connor

Head of Regulatory Change & Compliance , The Netherlands

Miriam Ruppert

Senior Manager, Regulatory Change & Compliance , The Netherlands

Bram Zwagemakers

Manager, Regulatory Change & Compliance , The Netherlands

Consulting

Digital compliance and value-adding opportunities

Digital Compliance focuses on the value that automation and RegTech - the use of information technology to enhance regulatory and compliance processes - can add across the compliance journey In this article, Synechron provides a practical reference guide to some ways financial institutions can integrate (new) digital technologies into key compliance processes, along with concrete examples of applications.

Synechron previously published an article on digital compliance entitled ‘The Case for Digital Compliance: Making compliance work for you’, on what drives the use of digitalization in compliance processes. In that article we concluded that this is a mixture of external, macro level drivers next to pain points felt by financial institutions in the form of increased compliance costs and elevated operational risks.

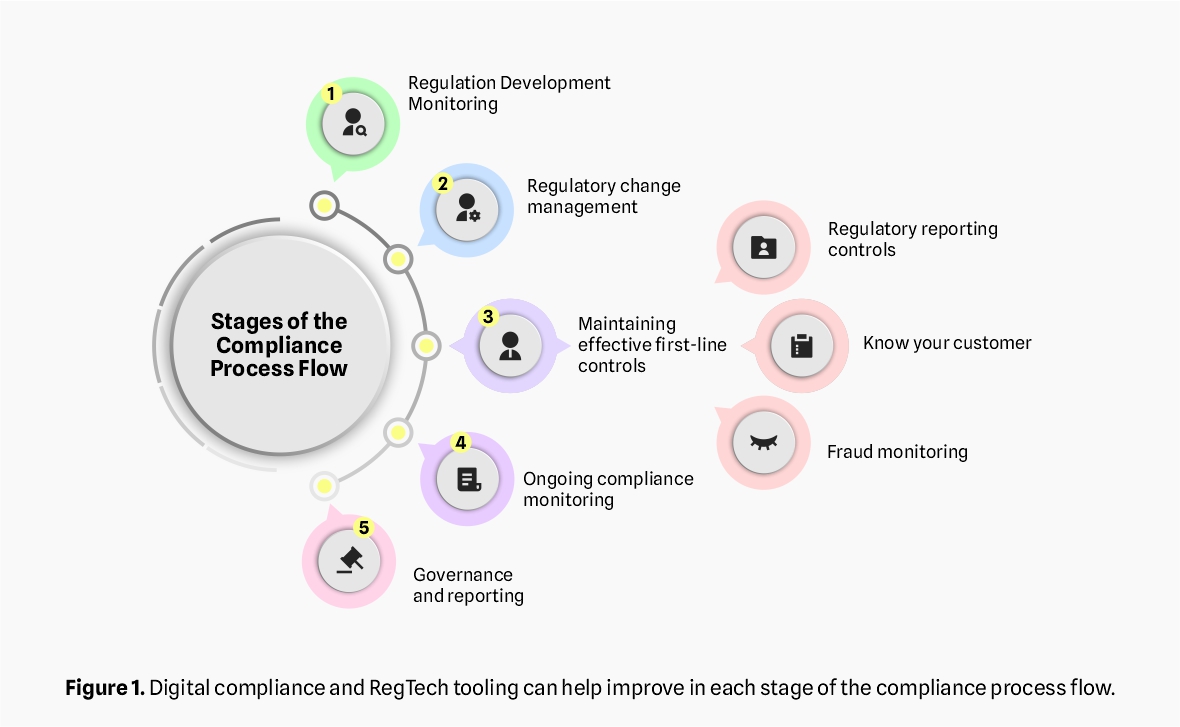

Overview of typical compliance process flow

The figure below sets out the generic stages of the compliance process flow defined by Synechron. This is followed by a directory-type itemized overview of diverse ways different Digital Compliance and RegTech tooling can augment specific parts of the compliance process.

Figure 1. Digital compliance and RegTech tooling can help improve in each stage of the compliance process flow

LEARN MORE. FILL IN THE FORM AND DOWNLOAD OUR WHITEPAPER.